Sustainable Value Analysis

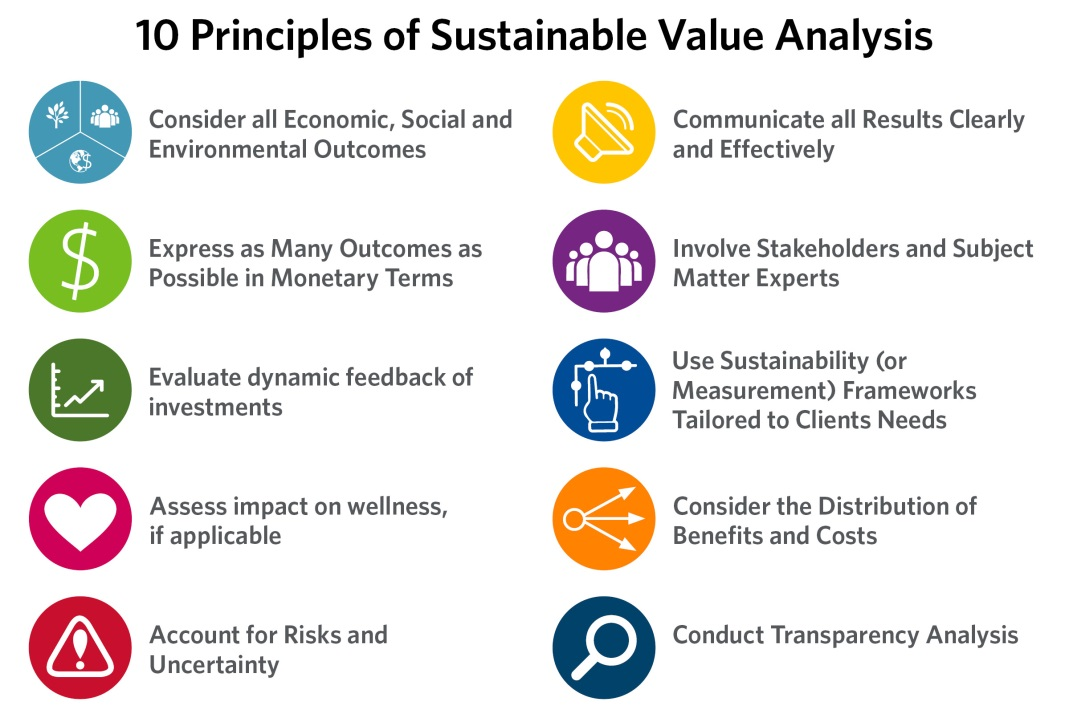

We have developed our Sustainable Value Analysis process to help our clients best assess their options. SVA is a thorough and transparent alternatives analysis that is adapted to our client’s specific goals. To make the concept of sustainability more objective, we have established an approach that is founded on 10 SVA principles of analysis.

SVA recognizes that decisions are not simply the matter of a sustainable return on investment — different economic tools are needed in different decision contexts. These tools can assist in making informed decisions about where and when funds should be invested. In addition, we develop project-specific metrics to help communicate the total value of a project.

Sustainability Valuation Methods

SVA consists of a suite of proven sustainability valuation methods that can be applied depending on the client and project context. The results provide decision support to help communicate the full value of your project by placing value on sustainable initiatives, including the direct, indirect and non-cash costs and benefits.

Corporate Sustainability Assessment

- Evaluate corporate initiatives, supply chain options, and facility risk from a triple bottom line perspective

Lifecycle Cost Analysis

- Builds on lifecycle cost accounting methods with non-financial indicators that can be expressed in monetary terms

Sustainable Return on Investment

- Assigns dollar values to benefit categories and produces monetary and non-monetary performance indicators

Multi-Objective Decision Analysis

- General approach to TBL accounting that is based on multi-criteria analysis methods with economics principles

Economic Impact Analysis

- Input-output model multipliers used to estimate jobs impacts of sustainable solutions

Value-Based Sustainability Rating

- Value-based frameworks generate simplified approach to evaluating a range of options.